— Originally Broadcast by Brandeis University ––

— International Business School’s Ben Gomes-Casseres explains why some companies are growing bigger while others are decentralizing —

Transcript of the episode:

LAWRENCE GOODMAN, HOST

Hello, and welcome to this edition of the Brandeis University podcast, “The Take: Big Ideas Explained in Under 5 Minutes,” where professors explain core concepts of their research in under five minutes.

Our topic today is, “Business Mergers: Are they good or bad?” I’m Lawrence Goodman with the Office of Communications, and my guest today is Ben Gomes-Casseres, a professor of business strategy at the Brandeis International Business School.

Thank you for joining us.

PETER A. PETRI PROFESSOR OF BUSINESS AND SOCIETY IN THE BRANDEIS INTERNATIONAL BUSINESS SCHOOL BEN GOMES-CASSERES

I’m glad to be here, Lawrence. Thank you for having me.

HOST: We’ve seen many big mergers in the last few years. What’s behind that trend?

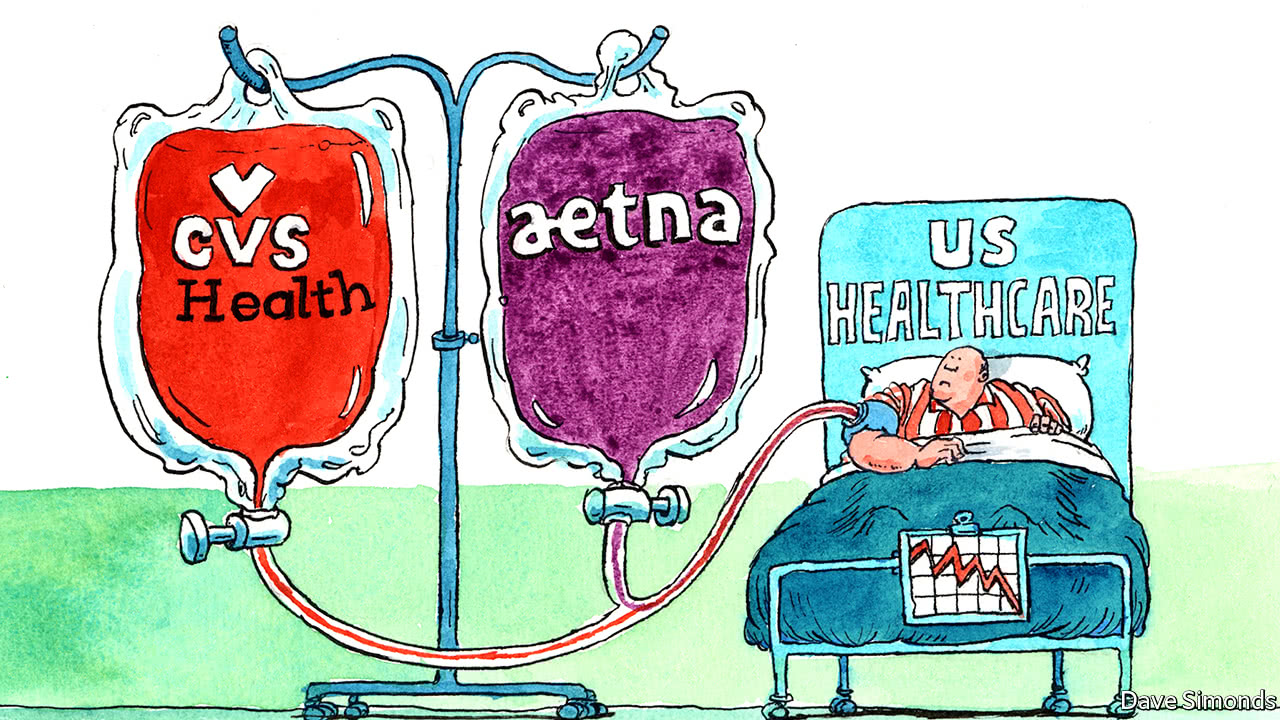

GOMES-CASSERES: It certainly has been the trend in the last three or four years. There’s been over 50,000 acquisitions or mergers worldwide and we’ve seen some really big ones in the last few years. For example, CVS acquired Aetna for $69 billion, Cigna acquired Express Scripts for $52 billion, and Bayer and Monsanto merged for $63 billion, and on and on. So these are very big deals, restructuring American business.

HOST: What’s behind this trend?

GOMES-CASSERES: So economic theory tells us that companies often merge or acquire another company in order to gain economies of scale or market power or to enter a new business. And today, I think they’re doing this in part to respond to new technologies and to globalization. So you find new companies entering the market, and you find incumbents kind of needing to reposition where they are using these acquisitions as part of their tools.

HOST: The average person wants to know, how does this affect him or her?

GOMES-CASSERES: Well, I think it affects every part of our life. Let’s take healthcare, for instance. So in the healthcare field, pharmaceutical companies have been acquiring biotechnology companies, hospitals have been merging with insurance companies, and retailers have also been merging. So this is affecting how healthcare is delivered.

We don’t quite know yet exactly what the impact will be, but these mergers have the potential to either improve services, increase the availability of services, as well as raise prices and suppress competition. So I think it’s a tight balance that we have to watch carefully.

HOST: A lot of people now are concerned about businesses becoming too big. Is that a problem?

GOMES-CASSERES: Louis Brandeis was concerned with this about 100 years ago. He felt that bigness in business was a curse and that it led to poor management and could hurt society and democracy.

So modern economic theory tells us that these mergers indeed can be positive. They can increase efficiency and economies of scale, but they can also increase the firm’s power to suppress competition. And we find that companies that perhaps expand too much find themselves getting dis-economies of scale where in fact, they’re not getting benefits, but they’re getting more costs than it’s worth.

HOST: “When there are more costs than it’s worth.” What’s going on there?

GOMES-CASSERES: They begin to have complexity in their management. And they’re not able to be as focused or maybe as innovative as competitors that are more focused. Pieces that are too far from your attention are an increasingly difficult task that leads to inefficiencies or leads you to fall behind.

HOST: And that’s why we see a lot of companies today going in the opposite direction, decentralizing.

GOMES-CASSERES: Yeah, so in the most extreme cases, a company like General Electric is breaking itself up into pieces by spinning off businesses. In less extreme cases, a company like Google, for example, decentralized how it manages some of its businesses, giving each a little bit more control over its operations rather than have it all centralized.

HOST: Do you expect to see more decentralization or more mergers?

GOMES-CASSERES: I believe that we are probably at a point where the merger rush has peaked. We’ve seen this trend towards decentralization and breakup of conglomerates. And in addition to that, we’ve seen an increase in the number of partnerships and alliances that are short of full merger.

HOST: If you were advising a business today, would you say smaller or bigger is the way to go?

GOMES-CASSERES: Don’t think that bigness is a solution to all your challenges. It can have more headaches than you think.

And consider the alternatives. A focused smaller business can be more nimble in the face of change. And partnerships short of merger may be a better way to join forces where it makes sense.

HOST: And there you have it. “Business mergers: Are they good or bad?” explained it under five minutes.

You can find this podcast on iTunes, Spotify and SoundCloud so we hope you’ll subscribe and keep listening to “The Take: Big Ideas Explained in Under 5 Minutes,” brought to you by Brandeis University.