By Ben Gomes-Casseres | Originally in HARVARD BUSINESS REVIEW |

M&A and partnership deals are at an all-time high. But what about competition?

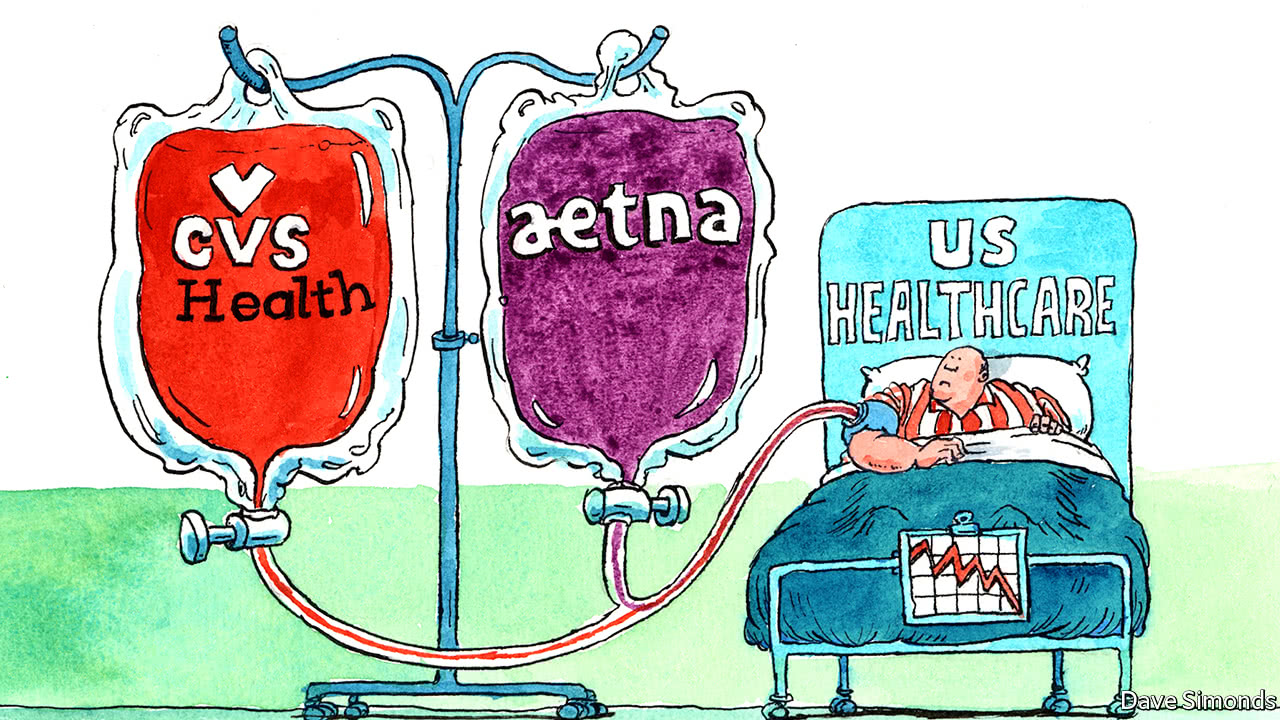

The U.S. Department of Justice (DOJ) wants to know too. It is reviewing or arguing this question in court for a slew of proposed mergers — AT&T-Time Warner, T-Mobile-Sprint, CVS-Aetna, and Express Scripts-Cigna, to name a few. A court decision on the AT&T-Time Warner deal is due out soon, and it will likely affect the prospects for many other cases.

Traditionally, antitrust regulation has looked for whether a merger increased or decreased competition in a particular market. Stated in this way, competition sounds like something you can measure, like mass or volume — there can be a lot or a little of it, or too much or too little.

Sometimes this model fits reality. In the case of Baker Hughes and Halliburton’s planned merger a few years ago, the Justice Department detailed how it thought the amount of competition would rise or fall (mostly fall) in 30 market segments. The merger was called off when the companies saw the DOJ’s tally, presumably because the parties expected they’d lose in court.

But other mergers suggest that competition is often more complex than that. It may be hard to measure competition as an amount that can rise or fall. Sometimes, the mergers affect the nature of competition itself: how firms behave, how markets are structured, and even how rivalries evolve over time.

Five types of competition are common in business today. Each type gives rise to certain kinds of deals, and these deals in turn can reshape the pattern of competition.

Horizontal competition occurs when firms compete in the same market — this is the type of competition that comes to mind most often. Think Baker Hughes and Halliburton in oil field services, or Staples and Office Depot in office supplies, or T-Mobile and Sprint in communications. The antitrust question in these mergers is the standard one already noted: Will the deal increase or decrease competition in the relevant market, as measured by market shares of the new entity and its likely competitive behavior?

This kind of competition often drives consolidation mergers, in which two firms combine their production and sales. The combined firm may benefit from economies of scale in doing so, but increases in market power may also result.

Vertical competition occurs when firms compete downstream with their buyers or upstream with their suppliers over the surplus produced in their transaction. This is commonly thought of as bargaining with a supplier or buyer. For example, Express Scripts and Anthem were partners in the medical supply chain. Their partnership recently ended up in court, with Anthem suing for $15 billion that it claimed it was owed from savings that its partner achieved but did not share.

A merger in this context may aim to better coordinate the supply chain by reducing the element of competition from the supplier relationship. While Express Scripts and Anthem didn’t revert to that solution for their conflict, the other mergers in the same space aim at precisely this (CVS-Aetna and Express Scripts-Cigna).

The effect on competition here is trickier to measure than with the horizontal type. The key issue is whether the merger reduces competition in the upstream or downstream market, or whether owning a supplier or a buyer gives the firm too much market power in its own industry. Either way, these mergers that span connected markets change the pattern of competition, because the firms that compete with each other now operate under one roof: CVS won’t need to bargain over the surplus with Aetna, or Express Scripts with Cigna.

Disruptive competition is yet another form of business rivalry, though it is not one often thought of in the context of mergers and antitrust enforcement. More commonly, we think of disruptive competition as the rise of a technology or business model that upends the existing order in an industry. This kind of competition is generally thought of as a good thing for consumers, though, of course, not for the incumbents who are deposed.

This kind of competition can also be affected by mergers and may in itself drive deal making. The DOJ opposed the 2011 merger that AT&T and T-Mobile wanted because it feared that the merger would threaten the role of T-Mobile as a disruptive “un-carrier” in the telecom industry. Incumbents may also strike deals to cope with disruption, as when today’s automotive companies invest in car-sharing services and autonomous vehicle technology. In some cases, firms may form partnerships instead of mergers in order to disrupt an industry — that is what Amazon, Berkshire Hathaway, and JPMorgan Chase say they are doing in their new health care alliance.

A number of Chinese acquisitions in the United States have recently been blocked by the Committee on Foreign Investment in the United States (CFIUS), an interagency committee led by the U.S. Treasury Department. The CFIUS argument in these cases has not typically revolved around increases or decreases in competition in the standard sense. Instead, the CFIUS has argued that the deals harmed the U.S. national interest by threatening technology leakage or undermining the health of U.S. competitors. For example, CFIUS blocked the proposed acquisition of MoneyGram by Jack Ma’s Ant Financial over data security concerns.

Collective competition is the fifth type of rivalry common today, though it has been around for years. In this model, firms cooperate with each other in groups to compete against other firms or other groups. Alliances short of mergers are used to coordinate the businesses of the firms that are members of these groups.

The members of these groups cooperate with each other internally and thus suppress competition among themselves. But the groups usually continue to compete externally with the other groups. The clearest example of this pattern is in airlines, where Star Alliance, Oneworld, and SkyTeam compete against each other as groups of allied firms. Smartphones offer another example, in which the members of the Android camp cooperate with each other to compete with the Apple camp.

Even when these groupings do not employ mergers to manage competition, the partners may well violate antitrust rules if their cooperation suppresses competition in the industry too much. (Cartels like OPEC are an extreme example of this collective competition.) For this reason, the airline alliances have been careful to request antitrust immunity before cooperating on pricing. Some airline partnerships have gotten this immunity on the argument that their particular travel markets will remain competitive even with their cooperation.

Because of this variety in how firms compete today, the market impact of mergers and partnerships is often hard to evaluate. In part, this difficulty is because we can never predict the future behavior of firms. But, more than that, there is not one measure or dimension to be evaluated, but several. The key question is how the deal affects the shape of competition, not just its intensity.